In the fast-paced world of business, the role of accounting software has evolved from being a mere tool for number crunching to a strategic asset that drives efficiency, accuracy, and overall financial excellence. As technology continues to advance, businesses are increasingly turning to sophisticated accounting software solutions to streamline their financial operations. This article delves into the myriad benefits of accounting software, examining how these tools contribute to improved productivity, enhanced decision-making, and long-term business success.

Time and Cost Efficiency

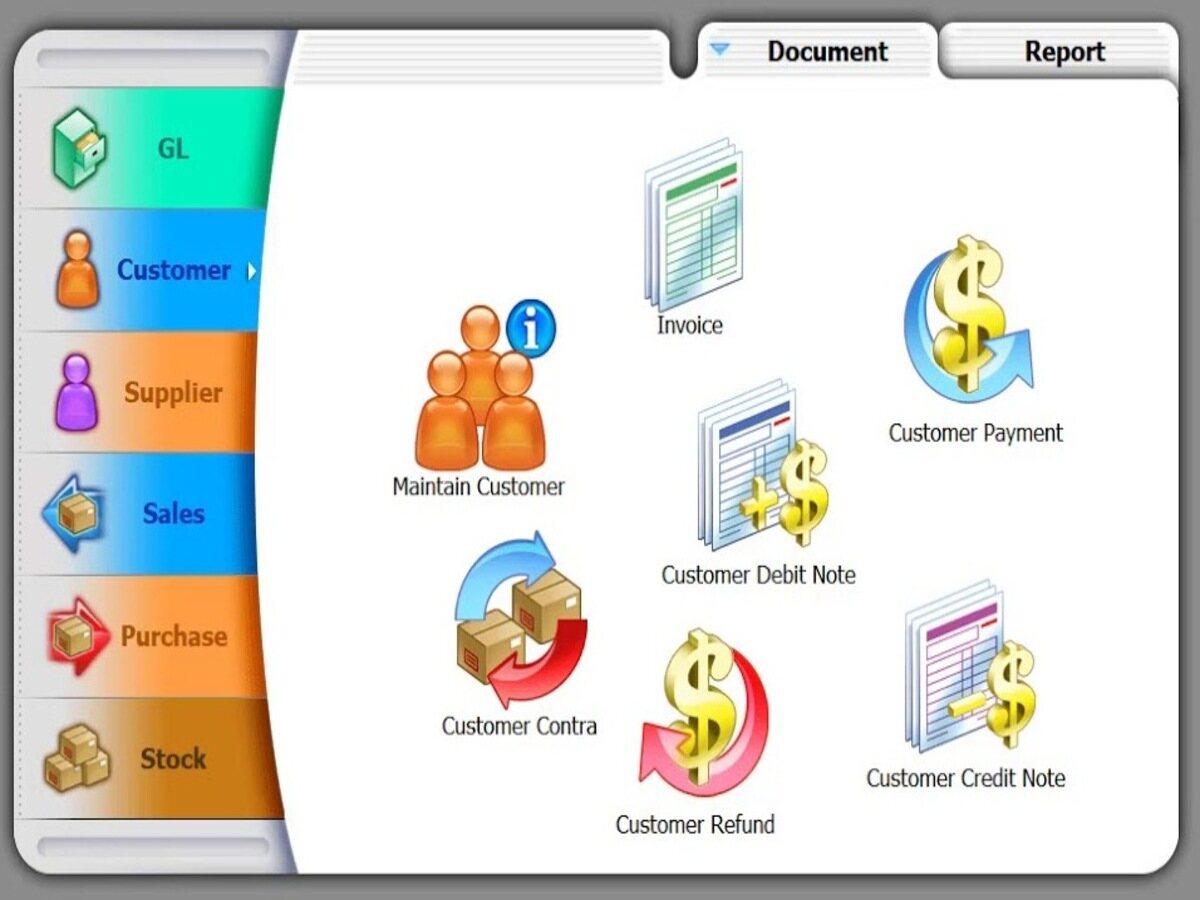

One of the primary advantages of accounting software like SQL Account Software is its ability to significantly reduce the time and effort invested in manual financial processes. Automation features inherent in these systems streamline routine tasks such as data entry, invoice processing, and reconciliation. This not only accelerates the pace of financial operations but also translates into substantial cost savings for businesses. By automating repetitive tasks, accounting software allows finance professionals to focus on more strategic activities that contribute to the overall growth of the organization.

Accuracy and Error Reduction

Human errors are inherent in manual accounting processes, and their impact can be far-reaching, affecting financial reporting, compliance, and decision-making. Accounting software minimizes the risk of errors by automating calculations and data entry. With real-time validation and built-in error-checking mechanisms, these systems ensure data accuracy, providing reliable financial information for informed decision-making. The reduction in errors not only enhances the integrity of financial data but also contributes to improved compliance with regulatory standards.

Real-Time Financial Insights

Cloud-based accounting software provides businesses with immediate access to real-time financial data. This enables stakeholders to make informed decisions based on the most up-to-date information. Whether monitoring cash flow, tracking expenses, or analyzing revenue trends, the ability to access real-time insights empowers organizations to respond promptly to market changes and make agile, data-driven decisions.

Enhanced Reporting and Analytics

Modern accounting software goes beyond basic financial statements, offering advanced reporting and analytics tools. Customizable dashboards and detailed reports provide businesses with in-depth insights into key performance indicators (KPIs), financial trends, and overall financial health. This analytical capability facilitates strategic planning, performance monitoring, and the identification of areas for improvement.

Improved Collaboration

Collaboration is a cornerstone of business success, and accounting software plays a pivotal role in enhancing collaboration among team members and stakeholders. Cloud-based solutions enable multiple users to access and work on the same financial data simultaneously. This is particularly beneficial for businesses with remote teams or multiple office locations, fostering seamless communication, and coordination among team members.

Scalability

As businesses grow and evolve, so do their financial requirements. Accounting software is designed to be scalable, accommodating the changing needs of businesses at different stages of growth. Whether a small startup or a large enterprise, these systems can adapt to increased transaction volumes, additional users, and evolving financial complexities. Scalability ensures that businesses can continue to rely on their accounting software as a reliable financial management tool as they expand.

Security Measures

Recognizing the sensitivity of financial data, accounting software prioritizes security. Robust encryption, secure user access controls, and regular software updates are integral components of these platforms. By implementing stringent security measures, accounting software protects sensitive financial information from unauthorized access and cyber threats, instilling confidence in users regarding the safety of their data.

Compliance with Regulatory Standards

Staying compliant with ever-evolving financial regulations is a complex task for businesses. Accounting software automates compliance processes by incorporating regulatory updates and ensuring that financial transactions adhere to the latest standards. This not only reduces the risk of non-compliance but also provides businesses with the peace of mind that comes with knowing that their financial operations align with regulatory requirements.

Cost-Effective Financial Management

Accounting software eliminates the need for extensive manual record-keeping and paperwork. This not only saves physical storage space but also reduces the costs associated with paper, ink, and other supplies. Additionally, the automation of financial processes minimizes the need for a large workforce dedicated to manual data entry, further contributing to overall cost-effectiveness.

Audit Trail and Financial Transparency

Accounting software maintains a detailed audit trail of financial transactions, documenting every change made to the system. This audit trail enhances transparency, allowing businesses to trace the origin of financial discrepancies, track modifications, and maintain a comprehensive record of financial activities. The ability to generate detailed audit reports is invaluable during internal audits and regulatory examinations.

Integration with Other Business Systems

Many accounting software solutions offer seamless integration with other business systems and applications. This integration eliminates data silos and ensures a cohesive flow of information between different departments. Whether connecting with customer relationship management (CRM) software, inventory management systems, or e-commerce platforms, integrated accounting software enhances overall business efficiency.

Remote Access and Mobile Capabilities

The advent of cloud technology has enabled accounting software to provide remote access and mobile capabilities. This means that users can access financial data and perform essential tasks from anywhere with an internet connection. This level of accessibility is particularly beneficial for businesses with remote or distributed teams, as well as for professionals who need to stay connected while on the go.

Conclusion

In conclusion, the benefits of accounting software extend far beyond the realm of number crunching. These powerful tools have become indispensable for businesses looking to optimize their financial processes, make informed decisions, and navigate the complexities of a dynamic business environment. From time and cost efficiency to real-time insights and enhanced collaboration, accounting software contributes to the overall success and sustainability of organizations across industries. As technology continues to advance, the landscape of accounting software will likely evolve, introducing new features and capabilities that further empower businesses on their journey towards financial excellence.